| February 5th, 2018 08:38 AM | |

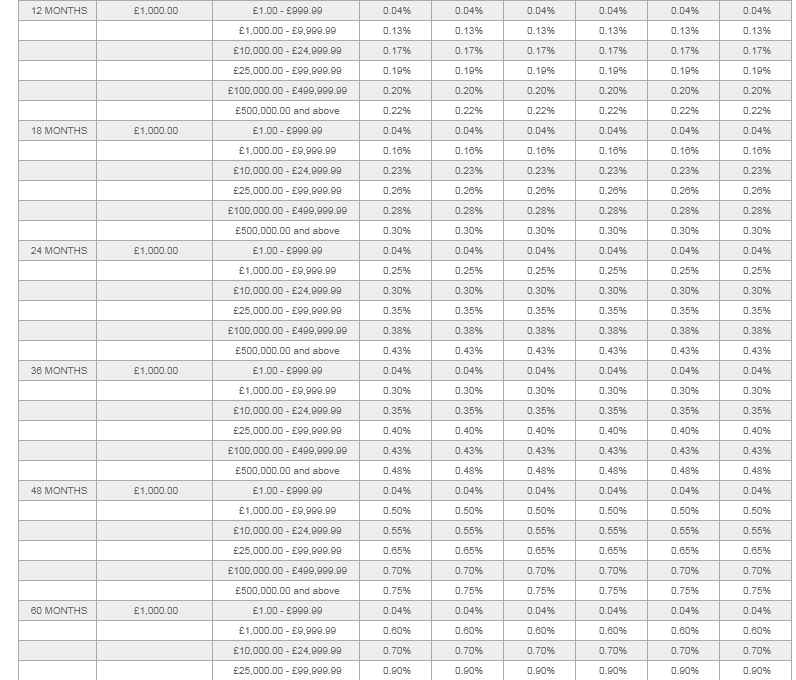

| prince karak | Re: pnc bank certificate of deposit At PNC bank the Certificate of Deposits are the easiest way to save if you don't need immediate access to your money. They usually pay of customers is a higher interest rate than a traditional savings or money market account and, generally, the longer the term that they invest for, the higher the interest rate. Types of CDs: Fixed Rate CD: 7 days to 10 years Ready Access CD: 3 to 12 months Callable CD: 36 or 60 months Variable Rate CD: 18 months Step Rate CD: 36 months Detail of PNC bank market rates for Certificate Of Deposit:    Here is detail of PNC bank market rates for Certificate Of Deposit: Fixed Rate Certificate of Deposit: The $1.00 - $999.99 tier is for Renewal Only Fixed Rate CD with Choice/Premium Plan Fixed Rate CD with Performance/ Performance Select/ VW Performance Fixed Rate CD only Term Minimum to Open Balance to Obtain Rates Interest Rate APY Interest Rate APY Interest Rate APY 1 MONTH $5,000.00 $1.00 - $999.99 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% $1,000.00 and above 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 3 MONTHS $1,000.00 $1.00 - $999.99 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% $1,000.00 - $9,999.99 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% $10,000.00 - $24,999.99 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% $25,000.00 - $99,999.99 0.07% 0.07% 0.07% 0.07% 0.07% 0.07% $100,000.00 - $499,999.99 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% $500,000.00 and above 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 6 MONTHS $1,000.00 $1.00 - $999.99 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% $1,000.00 - $9,999.99 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% $10,000.00 - $24,999.99 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% $25,000.00 - $99,999.99 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% $100,000.00 - $499,999.99 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% $500,000.00 and above 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 12 MONTHS $1,000.00 $1.00 - $999.99 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% $1,000.00 - $9,999.99 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% $10,000.00 - $24,999.99 0.17% 0.17% 0.17% 0.17% 0.17% 0.17% $25,000.00 - $99,999.99 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% $100,000.00 - $499,999.99 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% $500,000.00 and above 0.22% 0.22% 0.22% 0.22% 0.22% 0.22% 18 MONTHS $1,000.00 $1.00 - $999.99 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% $1,000.00 - $9,999.99 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% $10,000.00 - $24,999.99 0.23% 0.23% 0.23% 0.23% 0.23% 0.23% $25,000.00 - $99,999.99 0.26% 0.26% 0.26% 0.26% 0.26% 0.26% $100,000.00 - $499,999.99 0.28% 0.28% 0.28% 0.28% 0.28% 0.28% $500,000.00 and above 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% |

| February 5th, 2018 08:35 AM | |

| Unregistered | Re: pnc bank certificate of deposit Hello sir, I want to know the market rates of PNC Bank for Certificate Of Deposit? Please give me here PNC Bank Certificate Of Deposit market rates? |

| December 1st, 2015 03:53 PM | |

| nilesh | PNC Bank Certificate Of Deposit Discuss about pnc bank certificate of deposit here. Welcome to Courses.ind.in and this page is for pnc bank certificate of deposit discussion. If you are looking for information on pnc bank certificate of deposit then ask your question is as much details as possible in the “Reply” box provided below. The more detailed your question will be, the more easy will it be for our experts to answers your query. And if you have any updated or latest information on pnc bank certificate of deposit, then please share you knowledge with our experts in the “Reply” box below. Your reply will be published here and your knowledge can help many people. Thanks for stopping by at Courses.ind.in. Please visit again. |